HUD-Approved Agency Homebuyer Education Course

Alliance Credit Counseling is a HUD-approved agency homebuyer education course provider. Alliance has developed an online homebuyer education course with advice and expertise from our own experienced advisors and external professionals, including mortgage loan officers, realtors, settlement services, adult education specialists, and, last but not least, homebuyers! Alliance has worked with 176,000 homebuyers and homeowners for over 17 years.

What Does It Mean to provide a HUD-Approved Agency Homebuyer Education Course?

HUD-approved homebuyer education course providers are non-profit organizations examined and approved by the Department of Housing and Urban Development (HUD). which seek to offer time-honored and broadly-accepted expert advice on the home buying process and sustainable homeownership. The course provides these useful education and training services for a very low cost to future homebuyers.

HUD Approval Criteria for Providers of HUD-Approved Agency Homebuyer Education Course

Being an HUD-approved agency is not easy though. Certain HUD-approval criteria should be met before an agency can start offering housing counseling services. Below are some of the most important ones.

- Nonprofit Status – As demonstrated by Section 501 (c) of the Internal Revenue Code, the agency must function as a public or private nonprofit organization. The evidence of such status needs to be submitted prior to the approval.

- Experience – Aside from the nonprofit status, the agency must also have at least one year of experience in providing housing services and programs.

- Resources – Furthermore, the agency should have enough resources to implement its plans before the date of its HUD approval.

- Community Base – Lastly, the agency should have served for at least a year in the area/location that the agency opts to function.

Agencies may apply for the following:

- Local Housing Counseling Agency (LHCA)

- Intermediary (Regional or National)

- Multi-state Organization

- State Housing Finance Agency (HFA)

Benefits of Getting Homebuyer Education Course from a HUD-Approved Housing Agency

Benefits of Getting Homebuyer Education Course from a HUD-Approved Housing Agency

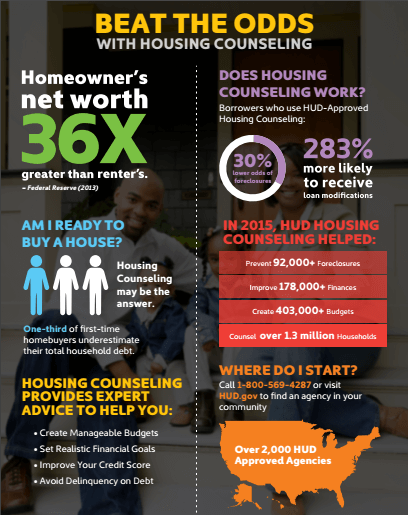

Americans can get several benefits by availing the services of an HUD-approved housing counseling agency.

For those who are planning to buy a new home, they can get pre-purchase counseling services and enroll to an HUD-approved first-time homebuyer education course, where a counselor helps them assess their financial situation and create a plan to afford their homes.

On the other hand, those who are struggling to pay for their homes can avail for the following services: foreclosure prevention counseling, bankruptcy counseling, and debt and credit solutions.